Credit Card

- Monthly Gifts: Please be advised that CanadaHelps deducts 3.5% of your gift for their processing fees.

- One-time Gifts: Please be advised that CanadaHelps deducts 3.75% of your gift for their processing fees.

If you would like to use your credit card and need any help, you may speak directly with CanadaHelps at (877) 755-1595.

E-Transfer

Please send e-transfers to info@gopeople.ca.

“I tried to donate to PI by e-transfer recently. Guess what? It is soooo easy! Great!!!. :)” – Donor

Cheques

- Make a cheque payable to People International Canada. (Please ensure you write People International Canada in full on your cheque.)

- Please do not indicate who you are donating to on your cheque(s). Indicate on the Donor Information Form only.

Direct Deposit

- To make recurring donations from your chequing or savings account, fill out the Pre-Authorized Debit form:

- Add a void cheque.

- Mail or scan and email it to the PI Canada.

If you would like to make changes to your pre-authorized donation, please send in a letter or scan a note with your signature stating what amount you wish to change to and the start date.

Mail:

People International Canada

1664 Tomlinson Common NW

Edmonton, AB T6R 3E2

Email:

info @ gopeople.ca

Donate securities:

A donation of securities or mutual fund shares is the most efficient way to give charitably. CanadaHelps is the largest processor of online security and mutual fund donations in Canada. And, they make it easy to disburse your donation across multiple charities.

Legacy Giving:

Make A Bequest In Your Will

Bequests are a giving of choice because they are easy to arrange. A bequest is communicated through your last Will and Testament. This can be done by giving a particular amount or a percentage of your estate. Your lawyer should assist you with this.

Benefits of a bequest gift:

- It’s simple: Leaving a gift in your Will is easy to arrange.

- It’s flexible: A gift in your Will can be made no matter how old you are or how much you have to give.

- It has tax advantages: A gift in your Will is a highly effective way to reduce taxes on your estate. This means you can pay less tax to the government and more to ministry.

- It has a lasting impact: Leaving a charitable gift in your Will gives you the satisfaction that the areas you felt strongly about in your lifetime will continue to receive support, even after you’re gone.

Other ways to give:

- Real estate

- Personal property

- Interest free loans

- Special event giving

- RRSP/RRIF accumulations

For more information on these other ways to give, please contact our office to discuss these options more in depth.

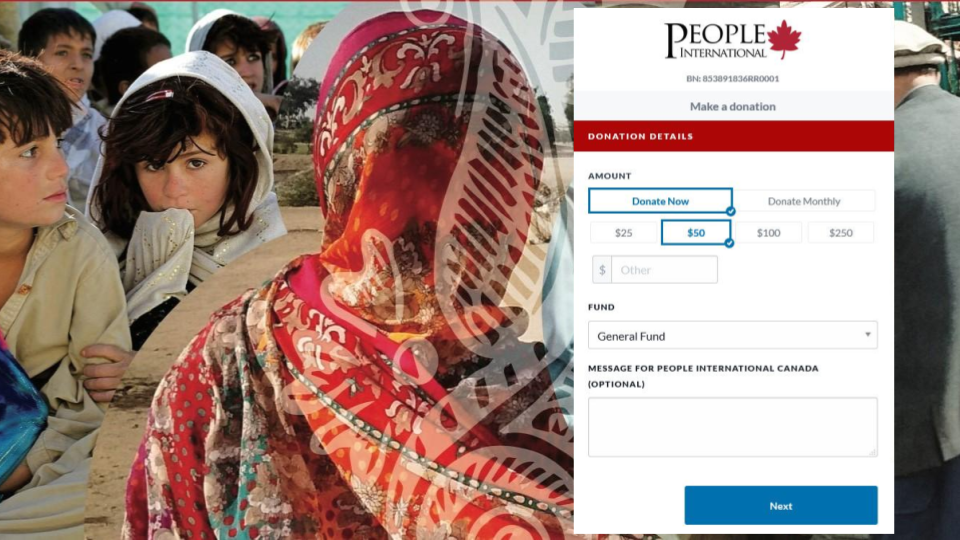

Any questions regarding donations or tax receipts can be directed to PI Canada. Our Charitable Registration number is 85389 1836 RR0001.

Your generosity has enabled the workers of PI to proclaim the good news of Jesus Christ in church plants across the region. The spiritually lost are hearing the Good News.

You must be logged in to post a comment.